Payment gateways are one of the most important features of any eCommerce store. The main motivation behind the success of any online business is, how well customers are converting. Now for customers to actually buy anything from your site, first they need to have trust in your store. Payment gateways can help you to develop that trust. According to Woocommerce, having a properly set-up payment gateway system not only creates trustworthiness but also significantly drops the cart abandonment rate.

According to Forbes, just in UAE, the online sales crossed a whooping $2B mark, this goes on to show the potential of online business in UAE.

To get your piece of pie it is important for you to spend some time on deciding which payment gateways you should offer on your store.

There are so many options for payment gateways that it becomes difficult to choose one as you have to see your own convenience as well as that of the customers. We have listed below some of the best payment gateways in UAE with their pros and cons, this will help you to decide what you need and what you don't.

What is a Payment Gateway?

Before we go into the details first I will briefly explain what payment gateway is and how it works. According to Wikipedia, “A payment gateway is a merchant service provided by an e-commerce application service provider that authorizes credit card or direct payments processing for e-businesses, online retailers, bricks, and clicks, or traditional brick and mortar. The payment gateway may be provided by a bank to its customers, but can be provided by a specialized financial service provider as a separate service, such as a payment service provider.”

How does it work?

Not all the payment gateways work in the same manner but more or less following steps are involved:

- A customer visits the site and places an order at the checkout, he may need to enter his credit card details.

- The website then securely sends the purchase details to the payment gateways.

- The payment gateway then sends the details to the seller's bank, where his account is.

- The merchant's bank then contacts the buyer's bank and exchanges the purchase details.

- If the information entered by the customer is right the bank then authorizes the transactions and amount are deposited in the seller account from buyers account.

- Payment gateway then returns the information to the website which then let the customer know if the purchase was successful.

You might like to read about: Top IT Companies From UAE that are changing the Tech Landscape

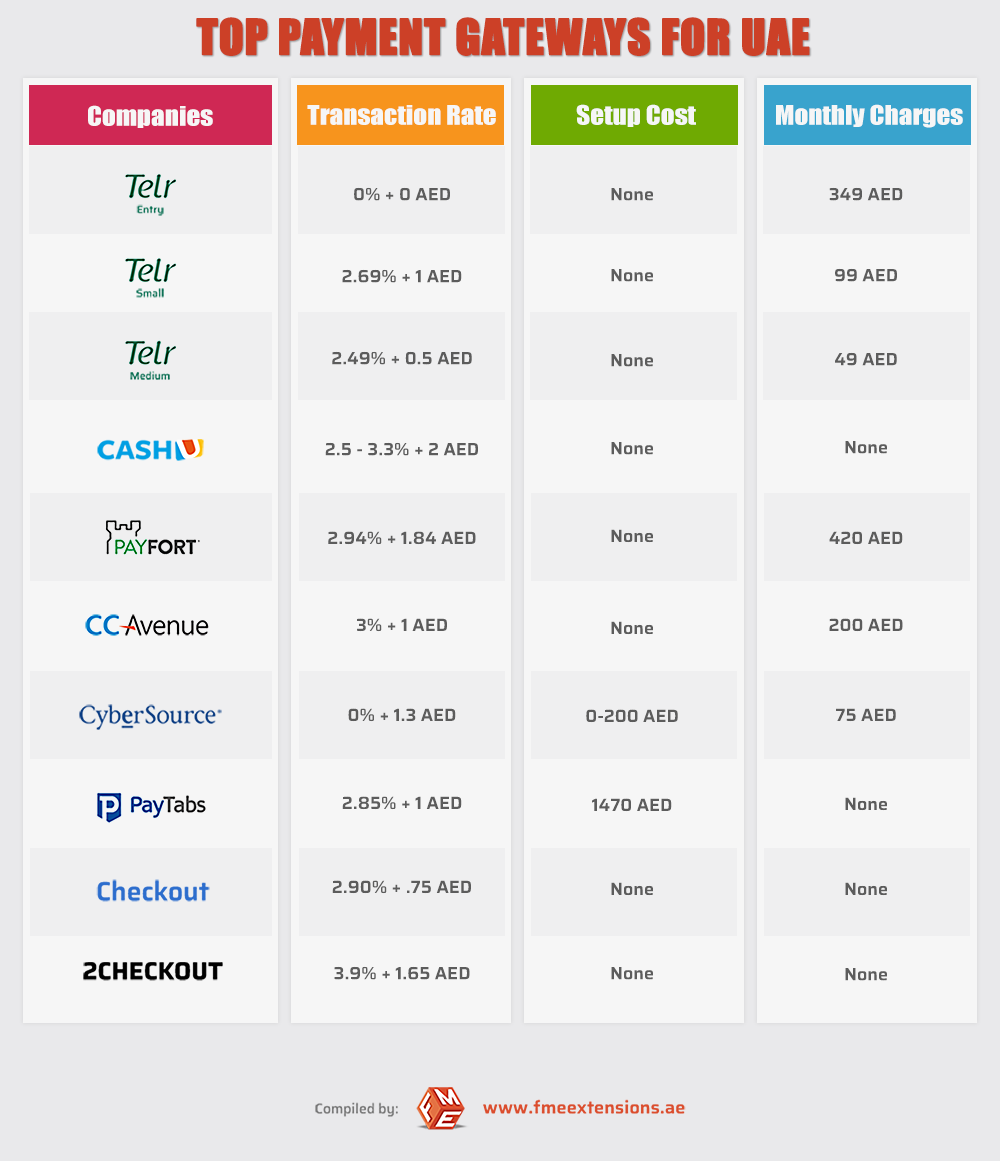

At a glance:

A brief summary of all the important information regarding gateways are presented below:

Embed this:

<a href="https://www.fmeextensions.ae/blog_ae/wp-content/uploads/2017/08/PaymentGatewayDubai.png"><img src="https://www.fmeextensions.ae/blog_ae/wp-content/uploads/2017/08/PaymentGatewayDubai.png" alt="Best Payment Gateaways For UAE" width="800" /></a> <br /> <strong>Compiled by – <a href="http://www.fmeextensions.ae/">Fmeextensions Dubai</a></strong>

List of Online Payment Gateways For UAE

1. Telr

Initially known as Innovate Innovate Payments, it was once considered as one of the best startups of UAE. Telr offers its service in more than 120 currencies worldwide. One of the unique features of Telr is that they offer their services in developing countries like Indonesia and Pakistan. Their monthly cost is AED 349, AED 149, and AED 99 for entry, small and medium level accounts respectively.

There are no charges on the remittance to the merchant account for the entry-level plan.

2. CashU

CashU was established in 2002 with the sole purpose of serving customers in the UAE but it has now become very popular in Europe as well. Interestingly, CashU offers free account creation and has a maintenance charge of 1$ per year which is lowest in the market. Per transaction charges depend on the amount of transaction. A complete list of all the charges can be found here. Quite recently CashU has also started their virtual credit card service with the collaboration of MasterCard. UAE residents with a registered CASHU account will be able to create their Virtual MasterCard Prepaid Card instantly, to make payments on e-commerce portals that accept MasterCard.

3. PayFort

Payfort is one of the most widely used payment gateways in UAE region. They recently changed their pricing plans. Now Payfort is only offering two pricing options, starter and Enterprise. For starter package, the monthly fee is 420 AED while for each transaction they charge 2.94 + 1.84 AED. Enterprise package is custom based which depends on the scale of your business.

With the collaboration of SOUQ.com(Now owned by Amazon), an online e-commerce giant in UAE, PayFort has also launched their Card-On-Delivery(COD) service. Basically, Card-on-delivery means that payment-on-delivery customers will now have a choice of paying by cash or by card. The delivery agents are able to process all major credit and debit cards using a mobile card machine.

4. CCAvenue

Started in India, CCAvennue is now a popular online payment gateway in UAE. They also offer zero setup fee option but that comes with a large monthly maintenance fee of $54.45. They also charge 3% on every transaction. CCAvenue is quite certainly an expensive option but they also offer a couple of free services like fraud prevention and 24/7 on-call support. They also support all major e-commerce platforms.

5. CyberSource

CyberSource is a part of well known international firm VISA. They operate in more than 190 countries around the globe and offer multiple solutions. CS also supports digital payment methods such as Apple Pay and Android Pay, as well as regional digital wallets such as Alipay, and KCP. Below are the details of their service charges:

6. PayTabs

A Bahrain based service provider that topped the list of best business start-ups in 2016 compiled by Forbes.They are offering their services in 168 currencies. You can set up complete PayTabs system in less than 24 hours. There is a number of ways you can integrate PayTabs like Plug-in, iFrame, SDK or direct integration by use of API. Currently, they are charging 2.85 % + 1 AED per transaction.

The setup cost is $400 while each withdrawal costs up to $15. Paytabs is not charging any monthly or annual maintenance fee.

7. Checkout

Working since 2010, Checkout started its service in UAE in 2014. They are charging 0.95% + 20 cents per transaction for European cards and 2.90% + 20 cents on non-European cards. They accept all the major credit cards around the world. They are also offering one of the best fraud management systems which they named as “Prism Risk Management System”.

8. 2Checkout

While 2Checkout is a USA based service provider but it is very popular in MENA region. They are charging 3.9% + 45 cents per transaction while serving in 87 currencies. They are also charging 1.5% for the customers outside UAE and $25 for every chargeback. These costs may look high but at the same time, there is no set-up fee as well as no monthly maintenance fee.

9. HyperPay

Hyperpay is basically a Saudi Arabia based payment gateway but they offer their service in UAE as well. HyperPay has more than 100 partners from a wide variety of banks to well-known credit card companies. It also offers very easy integration with major e-commerce platforms i.e Wordpress and Magento. HyperPay offers one of the best and highly secure fraud management system

You might like to read about: Top Startups in Dubai (UAE) For 2020

Conclusion:

As there are a number of options available and each one has its own advantages and disadvantage, you have to decide what will work for you. One thing to keep in mind is that you might opt for a basic package for any of the gateway which might look lucrative now but as your e-commerce website in UAE grows you will have to go for the enterprise or the premium version of that gateway. You have no other option but to buy that expensive package. So before choosing anyone, plan well for the future. You can also contact a professional web development Dubai company that will help you in taking this critical decision.

Nice information. Thanks for sharing. But i would like to know its barriers. My findings says that most of the people don't have credit cards there. Is it true?

Yes you are right. This credit card phenomenon is new in the Middle East, but it's catching up.

Very good information, thanks for that. Could you please provide me the charges of other gateways not listed in the table.

Is it possible or how difficult to change the gateways later on ?

Best regards,

Shafeeque

Hi Shafeeq

Thanks for liking the post. As there are many other payment gateways availabe but the listed in the article are the ones that I Think are suitable for UAE. Regarding the change in the payment gateway, it is not that difficult.

Very well done the comparison.

I have to decide for a gateway payment provider and your useful information will help.

Thank you

Thanks for your nice article it is really informative. I just have one question.

in the chart you mentioned that checkout is 0.00 cost setup and monthly fees, while in the description you mentioned they take 500 one time setup fees, I am confused. Can you explain please?

Thanks in advance for your cooperation.

There is no initial cost for checkout. Thanks for mentioning that, it's been corrected.

Great info, But they've changed rates for payfort recently. just FYI

Yes, thanks for pointing that out. I have updated the article.